CONSULTING AND INTERIM MANAGEMENT

Assess your business, manage your risks, strengthen your team – we put our resources to work for you.

How we can with you!

Valuation and financial expertise

Take advantage of our teams’ expertise to evaluate your company and its brand

Interim financial management

Whether you’re faced with an increase in activity, the absence of an employee, or the need for training or expertise, you can rely on our multi-skilled finance team.

Audit and internal control diagnosis

Improve your risk management

Valuation and financial expertise

Take advantage of our teams’ expertise to evaluate your company and its brand.

We draw on recognized financial, sectoral and transaction databases and analysis tools (IQ Capital, Markables, etc.).

Purchase Price Allocation (PPA)

Allocating the purchase price of a company and determining residual goodwill can have a significant impact on the presentation of your consolidated financial statements and your financial communications.

See more

Our teams have developed specific know-how to help you enhance the value of your brands, R&D costs and customer portfolios…

Impairment Tests

As part of your closing processes, you need to document the value of certain assets.

Our teams will work with you to carry out your valuation tests on the basis of structuring assumptions recognized by the market (WACC, tax rate, perpetual growth rate, etc.).

Company valuation

There are several methods for valuing a company, such as :

– Transaction multiple

– Stock market multiple

– Discounted Cashflow (DCF)

– Net asset value.

Our teams can help you add value to your company by carrying out :

– market research

– an analysis of your financial statements

– an analysis to build your business plan and finally by valuing this data according to one or more valuation methods.

Valuation of BSPCE, BSA

When issuing BSPCEs (Bon de Souscription de Parts de Créateurs d’Entreprises) or BSAs (Bon de Souscription d’Actions), you must :

– value your company’s shares

– document any difference between the historical value of your company’s shares and the value of the shares obtained following the exercise of BSPCEs in connection with the cancellation of dividend or voting rights.

Our teams will support you in valuing your company and BSPCEs according to the type of share chosen

Interim financial management

You are looking for an interim manager for :

– Coping with a surge in activity (putting together a financing file, enforcing your team on an operation, setting up performance indicators, etc.)

– Compensating for an employee’s absence

– Helping your finance teams to make progress on complex issues

– Provide you with financial expertise by adapting the monthly duration of our services to your needs.

See more

We adapt to your constraints to offer you tailor-made solutions by seconding chartered accountants or finance teams to your finance departments.

The added value of Altermès is :

– skilled speakers, often with dual experience in consulting firms and companies

– support from the Altermes community of experts

– assignments of any duration

– a multi-sector scope: utilities, infrastructure, real estate, healthcare, new technology…

– clear fees, by subscription or fixed price.

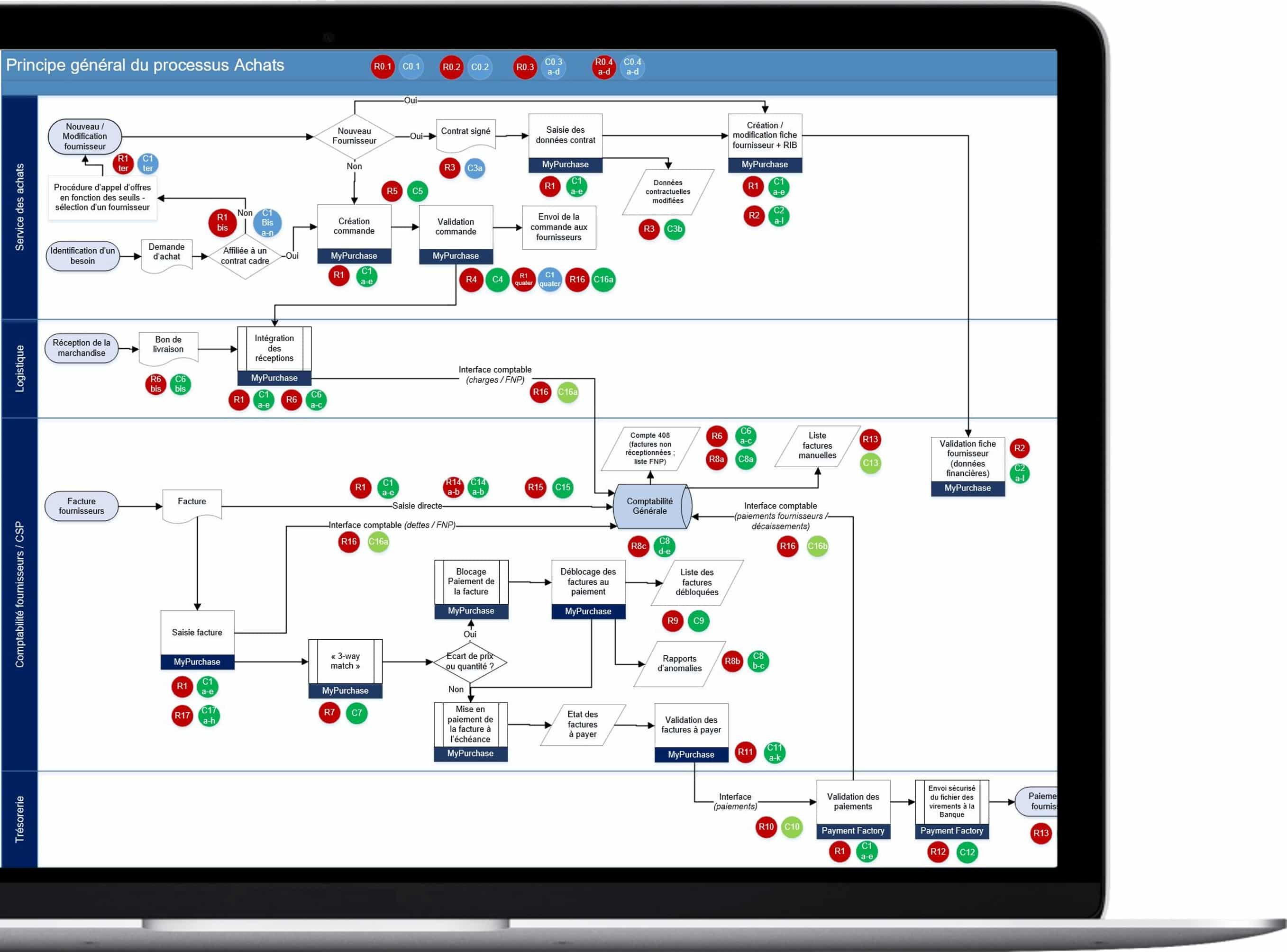

Audit and internal control diagnosis

Manage your risks thanks to our expertise in building a system to cover major risks (financial, compliance, operational, fraud, etc.).

Altermès can help you with :

– Building your company’s risk map

– Definition of the audit plan and internal control program and their operational implementation

– Co-production or subcontracting of audit and internal control work

Our latest news CONSULTING AND INTERIM MANAGEMENT

Adding value to a company’s real estate assets?

Valuing a company’s real estate assets is an approach often neglected by entrepreneurs.

BSPCE, BSA, AGA, stock options… how to involve employees in the company’s development?

At a time when the younger generations are increasingly looking for meaning in their work, employee involvement and retention remains a top priority for company managers.

Our solutions

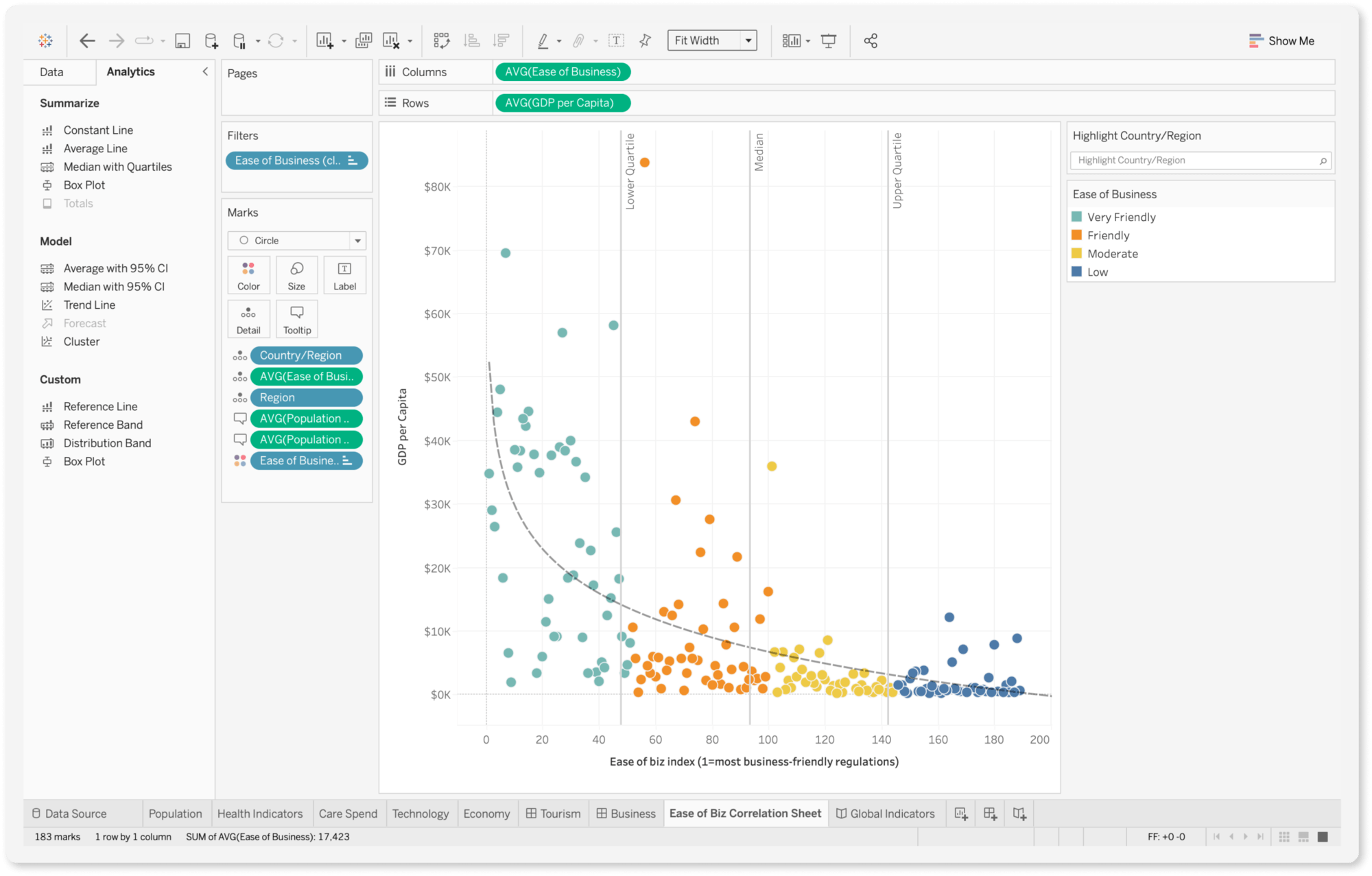

Discover the tools we use to bring you even more added value:

Our latest case studies CONSULTING AND INTERIM MANAGEMENT

Our referents

CONSULTING AND INTERIM MANAGEMENT

Matthieu Henry d'Ollières

Chartered Accountant and Statutory Auditor, Partner Altermès

mhenrydollieres@altermes.fr

+33 1 88 38 09 80

Matthieu Fournier Le Ray

Chartered Accountant and Statutory Auditor, Partner Altermès

mfournierleray@altermes.fr

+33 1 88 38 09 80

Contact us

Not a minute to lose

+33 (0)1 88 38 09 80