Consolidation of accounts is a strategic operation that enables a parent company to present a coherent overall view of its group. Financial statements may be consolidated internally by the Group's finance department, or externally by an accounting firm with expertise...

Our Latest news Accounting expertise

Guide to changing accountants ?

In the life of a company, it can sometimes be necessary to change accountants.

What is cost accounting?

Cost accounting provides objective accounting data on a company’s various expense and revenue items.

The importance of the chartered accountant to the company

The figure of the chartered accountant is inextricably linked with the world of business, but his or her function remains unclear to many entrepreneurs.

What is the tax situation for French nationals living abroad?

You live in a country other than France and don’t know where to pay your taxes?

Are you preparing to move abroad and want to know what taxation will apply to your new situation?

Advantages and disadvantages of a company for the liberal professions

If you are a self-employed professional, you have a choice of different legal forms for your business.

Why set up an asset holding company?

The patrimonial holding company is a little-known legal structure, yet it offers numerous tax advantages and greatly facilitates the transfer of business ownership.

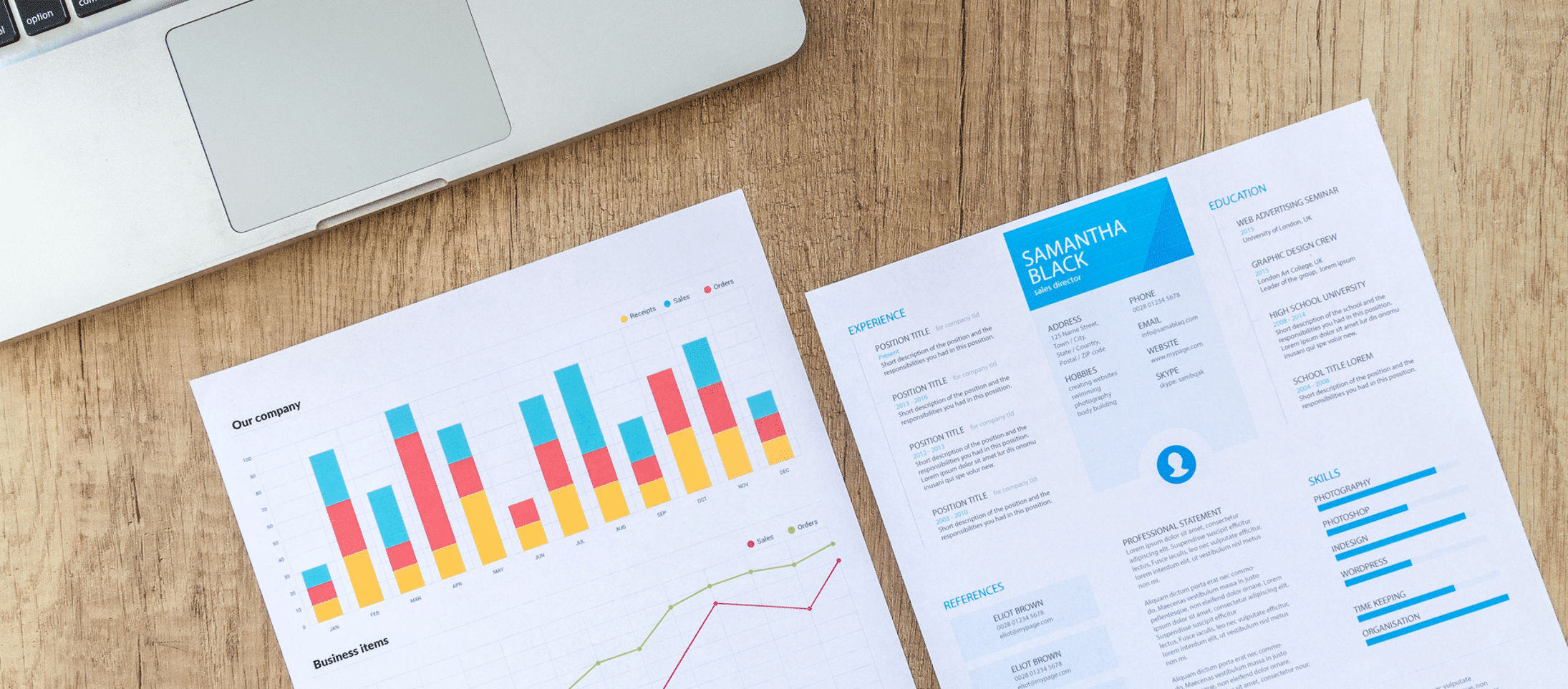

Create a business plan + free template

Before setting out to create your own business, it’s essential to get your ideas straight.

Principle, advantages and disadvantages of a family SALR (LLC)

SARL de famille: specific features, advantages, disadvantages and special conditions. Find out all about this legal status.

Becoming a chartered accountant or statutory auditor?

Are you interested in financial expertise and the numbers business? Do you have questions about public accounting and auditing?