Contributing shares to an asset holding company is a common way of optimizing the sale of assets. It offers a definite reinvestment advantage over owning shares. The operation nevertheless requires the involvement of a contribution auditor to validate the company’s valuation, and a chartered accountant to support the creation and management of the new company.

Matthieu Fournier le Ray provides an update on the nominal operation of a contribution of shares to an asset holding company:

Principle

Technically, at a given point in time, you will contribute your shares in kind to a holding company to be created.

To do this, you will need a contribution auditor who will certify the value of the contribution.

In the short term, this structuring will enable you to :

- enhance the accounting value of your company

- compartmentalize certain transactions within the holding company

- store dividends in the holding company without significant tax friction

- make other investments through the holding company

In the long term, this will give you a major tax advantage, since it will freeze capital gains for income tax purposes and optimize reinvestment opportunities!

A concrete example

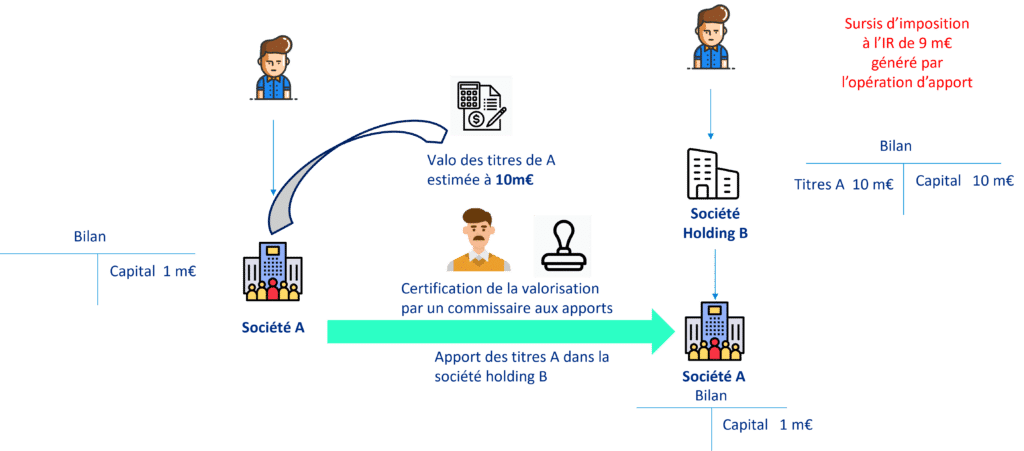

Step 1: contribution of shares to the holding company

- You own a company A with a share capital of €1m.

- A few years later, you value it at €10m. The company’s shares are therefore worth €10m.

- This valuation must be certified by a contribution auditor. This will enable you to contribute these shares worth €10m to a holding company B, whose shares will be carried on the balance sheet as assets for €10m in return for capital of the same amount.

- At this stage, the capital gain is tax deferred, so nothing happens for tax purposes with regard to this contribution of shares. You only need to enter your tax deferral on your income tax return.

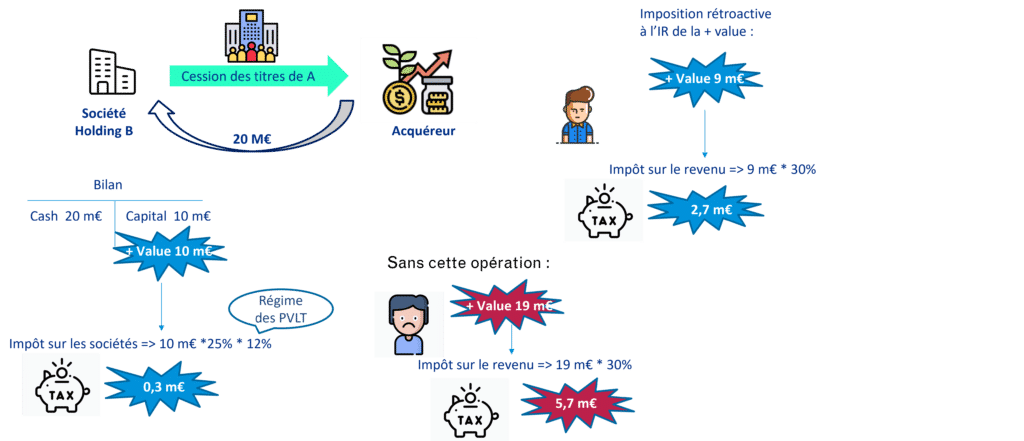

Step 2: Sale of company A in 2026

- In 2026, you sell your company A to a buyer for €20m.

- Your holding company will therefore have €20m in cash and will then make a capital gain of €10m, corresponding to the difference between the value of the €10m shares at the time of the contribution and the €20m sale price.

- This capital gain will be taxed as a long-term capital gain at 12% * the corporate income tax rate, giving you a corporate income tax charge of €300,000 at a corporate income tax rate of 25% (corporate income tax => €10m *25% * 12% ).

- This gives you €19.7m in cash available for reinvestment in this holding company.

- As regards the €9m tax deferral referred to above, it remains in force as long as you do not sell the shares in the holding company.

- If you hadn’t done this little structuring. The entire capital gain of €19m would have been subject to income tax, i.e. the flat-tax of 30%, giving a tax charge of €5.7m and a reinvestment capacity for you of €14.3m.

- We have a substantial difference linked to this structuring

Conclusion

As you will have understood, this operation is virtuous for the entrepreneur, who can reinvest the capital gain available in his holding company following the resale of his shares.

In addition to the legal aspects, we recommend that you call on the services of professional accountants (commissaire aux apports, chartered accountants and/or tax lawyers) to help you carry out this operation.

👆 If you have a question, a project or would like to find out more about how contributing shares to an asset holding company works, contact our teams of experts!

🔎If you’d like to find out more about our wealth management expertise,

👆 Need another source? We’re sharing an article from our friends at Les Echos on the benefits of the system!