VALUATION AND FINANCIAL EXPERTISE

Take advantage of our teams’ expertise to evaluate your company and its brand

Our scope of intervention

Transactional valuation

Benefit from assistance in defining and enhancing the value of your project, and fine-tuning your price negotiation strategy.

Tax valuation

Rely on an expert to justify and document a transaction with the tax authorities

Accounting valuation

Choose to receive support in understanding valuation issues relating to accounting standards: purchase price allocation, impairment tests, etc.

Management package

Benefit from specific expertise in thevaluation of financial instruments

VSE / SME offer

Our experts offer a tailor-made approach adapted to your needs

Transactional valuation

Whether you’re planning an acquisition, a sale, a merger, the strengthening of your financial resources or the opening up of your capital, valuation is an essential factor in all these operations.

To support you at this strategic stage, we offer you our expertise and a tailor-made approach adapted to the context of the operation.

Our experienced team can assist you in :

- analyze the context of the operation and its conditions,

- carry out a financial analysis (historical and prospective),

- apply appropriate valuation methods (DCF, multiples, net asset value, etc.),

- make a reasoned analysis of the values obtained.

This work may be carried out in accordance with French or international accounting standards (IFRS).

Tax valuation

In the event of an asset transfer, legal reorganization or intra-group transaction, it is essential to be able to justify the valuation adopted to the tax authorities.

For this type of operation, our experts will work with you to :

- study the legal and tax context of the operation to identify the main issues;

- identify and apply appropriate valuation methods (DCF, multiples, net asset value, etc.) and parameters,

- prepare robust documentation to meet the needs of the tax authorities.

Our team includes specialist lawyers who can provide additional assurance on the tax valuation of your assets.

Accounting valuation

The application of French and international accounting standards may require us to deal with valuation issues. This is notably the case for purchase price allocation (or “PPA”) and impairment testing.

In such a case, we can advise and assist you on these accounting issues with :

- for purchase price allocation: analysis of the transaction and determination of the purchase price, identification of intangible assets and estimation of the fair value of the various assets and liabilities, drafting of the related documentation and management of exchanges with the CAC;

- for impairment testing: assistance in estimating future cash flows, determining the valuation parameters and estimating the fair value of the assets tested, drafting the related documentation and managing exchanges with the CAC.

This work may be carried out in accordance with French or international accounting standards (IFRS).

Management package

Management packages are a profit-sharing tool that enables executives and managers to acquire a stake in the company they work for. It is an essential tool for aligning the interests of executives and shareholders by associating them with the company’s performance.

Management packages can include several types of incentive, some of which are free and others paid for: free allotment of ordinary shares (AGA), free allotment of preference shares (AGADP), stock option plans (SO), business creator share subscription warrants (BSPCE), ordinary shares (AO), preference shares (ADP), share subscription warrants (BSA).

The valuation of these financial instruments requires specific know-how. Our experts can help you to :

- learn about the issues at stake and the objectives pursued,

- analyze the terms and conditions of the financial instrument,

- for optional financial instruments, model probabilities of occurrence,

- select the valuation method according to the instrument’s characteristics (Black & Scholes, Monte Carlo, etc.),

- simulate instrument values as a function of variables,

- draw up related documentation.

Small business offer

As part of our “SME” offer, we provide a tailor-made approach to your needs. You can benefit from our assistance in obtaining a :

- in a transactional context (acquisition or sale of shares/partnerships/businesses, mergers, fund-raising, opening of capital, etc.);

- in a tax context, in the case of an asset transfer or legal reorganization;

- in an accounting context;

- as part of the implementation of a management package.

Our teams include tax lawyers and wealth management advisors to help you secure your transactions.

Our experienced teams listen to your needs and work with you throughout your project.

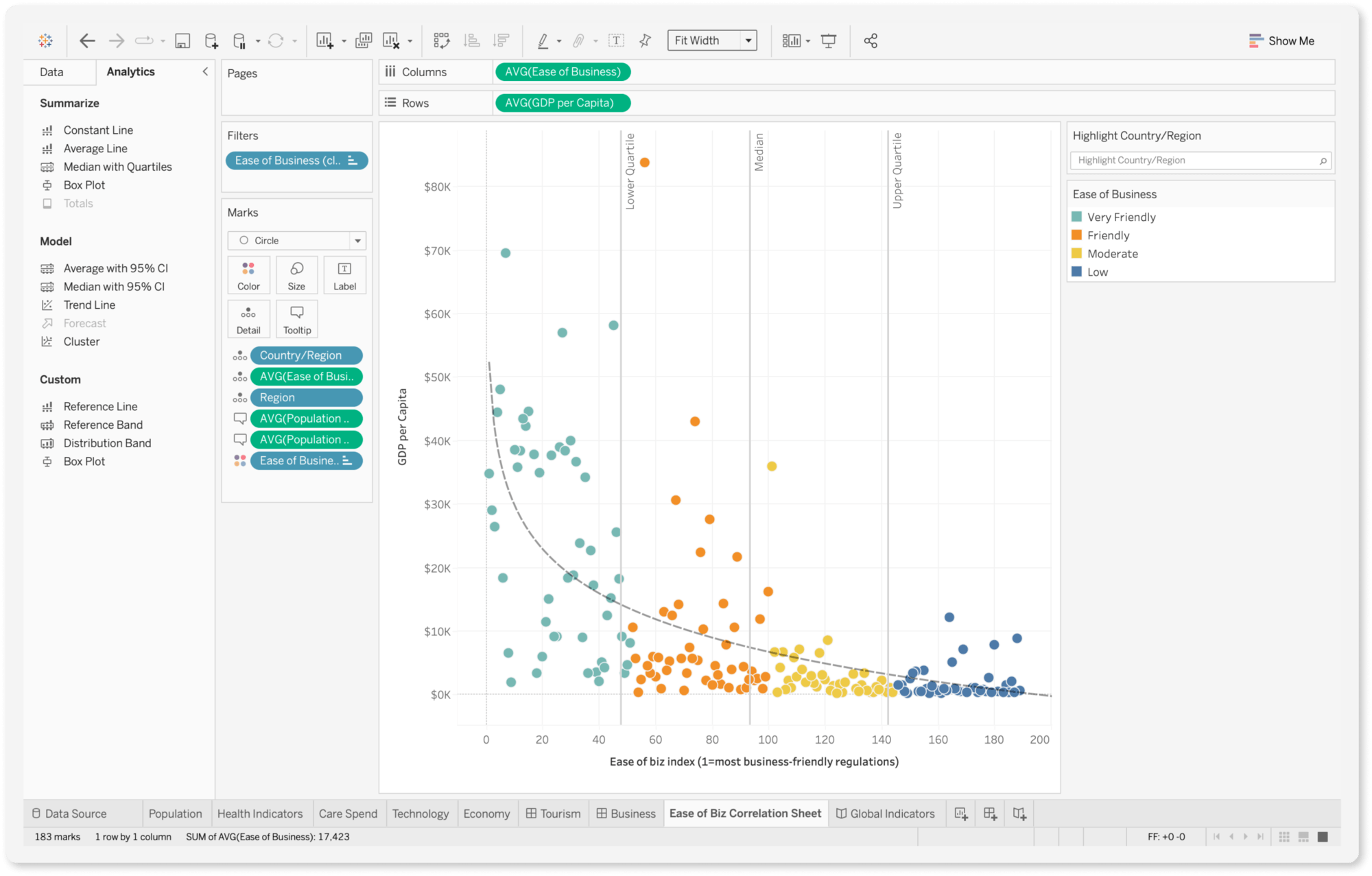

Altermès is a member of the CCEF (Compagnie des Conseils et Experts Financiers), and our team of experts uses recognized tools:

- for comparable transactions, we use Epsilon Research’s EMAT (Epsilon Multiple Analysis Tool) database. Epsilon Research, an independent financial research and analysis firm, has set up the EMAT database to collect transaction multiples for the valuation of unlisted European companies;

- for stock market comparables, we use the Capital IQ database. This is a business intelligence platform designed by Standard & Poor’s ;

- For the valuation of intangible assets such as brands, we use the Markables solution, which lists these assets on company balance sheets worldwide;

- In order to refine the actuarial data, we draw on the work of Professor A. Damodaran of Stern University (NYU), considered a benchmark in the field of corporate finance.

In addition, and in order to adapt to your specific needs and challenges, we have an analysis team that can carry out sector-specific studies.

Our solutions

Discover the tools we use to bring you even more added value:

Our latest case studies CONSULTING AND INTERIM MANAGEMENT

Matthieu Henry d'Ollières

Chartered Accountant and Statutory Auditor, Partner Altermès

mhenrydollieres@altermes.fr

+33 1 88 38 09 80

Thomas Baudouin

Director

Chartered Accountant

tbaudouin@altermes.fr

+33 1 88 38 09 80

Contact us

Not a minute to lose

+33 (0)

1 88 38 09 80