Context and progress of the mission

In the context of the preparation of the1st set of consolidated financial statements at December 31, 2019, following the creation of a holding company having acquired an operating entity in December 2019, the work of allocating the acquisition price had not yet been carried out. All goodwill arising between the purchase price of the shares and their carrying amount was recognized as goodwill.

Our assignment mainly concerned the valuation and documentation of this goodwill, in order to allocate the goodwill in the accounts to identified intangible assets such as the brand and the customer portfolio. This breakdown is crucial because some intangible assets are subject to amortization, while others are not.

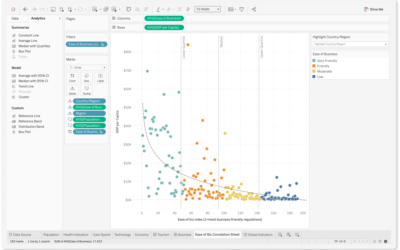

In addition, the assignment also involved constructing the impairment test used to calculate the company’s value in use. We have documented the choice of indicators used for this test (CMPM, IS rate, perpetual growth rate, etc.).

Sources used for analysis

- S&P Capital IQ as a financial database

- Markables, history of goodwill allocation on similar transactions in recent years

- Publicly available information on the software publishing sector and comparable companies

- Customer financial information

- Statutory auditor’s report

- Contractual documentation

📞 If you would like to have a company valued for asset management purposes, with a view to selling it, or following a buyout to assess the accounting impact, contact us!

🔍 If you’d like to find out more about our valuation and financial expertise services!