Our client has been the subject of a tax audit concerning VAT declared and collected and taxable income for the last 3 years. Our customer had undergone a high turnover in its finance and accounting teams, and asked us to help with documentation and exchanges with the tax authorities.

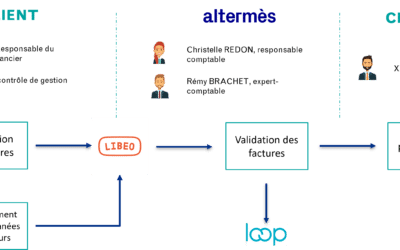

Mission organization

The mission began with discussions with the tax authorities to define the scope of the audit and the data transmission procedures.

We then worked with the accounting and finance teams to ensure that the required supporting documents were collected. We have ensured that our client’s calculations and operations have been properly understood by the tax authorities.

As such, we have produced technical notes (accounting and tax) to cover topics such as :

- the deductibility of certain provisions for expenses,

- reconciliation of FEC files with our customer’s accounting system,

- correct understanding of VAT reconciliation,

- restatements between accounting and tax results.

Tools used

- Accounting software

- Cegid Tax for tax purposes

- Word and Power Point presentations for client and tax authority feedback

Customer feedback

The tax audit went smoothly for our client, and was documented according to the expectations and schedule required by the authorities.

🔎 To find out more about our accountancy services, visit .

👆 If you would like us to assist you with a tax audit, contact us!